We cannot underestimate the importance of vacation rental insurance. You need to look at your vacation rental property as an investment, and the best business owners in the world recognize that their businesses need protection. Insured vacation rental properties are safe vacation rental properties.

Generally speaking, having insurance is always a good idea. Life is unpredictable, and you can never really know what’s going to happen. Insurance is a safety and security net. Yes, you may never actually need to make a claim, but is it a risk worth taking?

In this post, we wanted to dive into the vacation rental insurance options available on the market, the benefits, the drawbacks, and how Airbnb’s insurance plays a role in hosts’ protection.

What Does Vacation Rental Insurance Cover?

Great question, but sadly, there is no simple answer. The coverage changes according to the insurance provider and so does the price. However, there are a few benefits that remain constant throughout the different providers’ policies.

Most policies include property protection, which covers the likes of furniture and appliances inside your STR property. The policies also usually cover the building itself and any additional structures and liability coverage if a guest gets injured and tries to sue you as a result.

Additions that you can add to your primary insurance plans include inflation protection, protection from water damage, and all-risk coverage.

Most Important Things to Include in Your Vacation Rental Insurance Policy

Dwelling Coverage: This is the foundation of any home insurance policy. It provides coverage for damage to the physical structure of the property, such as walls, roofs, floors, built-in appliances, etc.

Personal Property Coverage: This covers the replacement cost of the property’s contents, such as furniture, electronics, and other personal belongings. For vacation rentals, it’s especially important since guests will be using your furniture, appliances, and possibly other items.

Liability Protection: This covers medical expenses, legal fees, and damages if someone gets injured on your property and you are found at fault. This is especially vital for rental properties, where various guests will be coming and going.

Loss of Rental Income: If a covered peril damages your property and it becomes uninhabitable, this coverage can compensate for the rental income you’d lose while the property is being repaired.

Vandalism and Malicious Mischief Coverage: Given that different people will be staying in your rental, this offers protection against damages or destruction caused intentionally.

Theft Coverage: While basic home insurance policies might have some theft coverage, given the transient nature of guests in a rental property, you’ll want enhanced theft coverage.

Fair Rental Value Coverage: If a covered loss prevents you from renting out your property, this coverage will reimburse you for the fair rental value.

Additional Structures: If your property has other structures like sheds, detached garages, or fences, ensure they are also covered.

Comprehensive Peril Coverage: Ensure your policy covers a broad range of perils, such as fire, lightning, windstorms, hail, etc.

Natural Disaster Coverage: Depending on your property’s location, consider adding flood, earthquake, or hurricane insurance. Many standard policies don’t cover these, so additional coverage might be necessary.

Accidental Damage Protection: Some policies or add-ons will provide coverage for accidental damage caused by guests.

Umbrella Policy: This is additional liability insurance that provides an extra layer of protection beyond your standard policy limits.

Short-Term Rental Endorsement: Since many insurers consider renting out your home on platforms like Airbnb or Vrbo as a business activity, you might need a specific endorsement or a commercial policy to be fully covered.

Pets and Service Animal Damage Protection: If you allow pets or service animals, consider coverage that protects against potential damage they might cause.

Replacement Cost vs. Actual Cash Value: Opt for a policy that offers “replacement cost” rather than “actual cash value.” The former pays to replace your property at current prices without deducting for depreciation.

What Does Vacation Rental Insurance Typically Not Include?

Strangely, most vacation rental insurance policies do not include coverage for natural disasters like sinkholes or earthquakes. They also often exclude maintenance, building code violations, costs of evictions, and theft. This differs between insurance providers.

What About the Insurance Provided by Airbnb?

Airbnb offers two forms of vacation rental insurance. First, let’s look at the Host Protection Insurance.

According to Airbnb, Host Protection Insurance is defined as – “In the rare event someone gets hurt, or their property is damaged during a covered stay at your place, you may be protected with up to $1,000,000 primary liability insurance.” This policy is available to all Airbnb hosts across the globe. It protects hosts from check-in to check-out. In Airbnb’s words, the policy may include:

-

Bodily injury to guests or others.

-

Damage to property belonging to guests or others.

-

Damage to common areas, like building lobbies and neighboring properties, is caused by a guest or others.

The other Airbnb insurance is called Host Guarantee. Airbnb categorizes this policy: “If a guest damages your place or belongings during a stay and doesn’t reimburse you, you may be protected with up to $1,000,000 property damage protection.”

Again in Airbnb’s words, the Host Guarantee may include:

-

Cover of damage to your property caused by guests.

-

Any damage to belongings caused by guests.

-

Damage caused by a guest’s assistance animal.

The Host Guarantee does not include:

-

Theft of cash and securities (e.g. savings bonds, stock certificates)

-

Damage from ordinary wear and tear

-

Bodily injury or property damage to guests or others (those may be covered by Host Protection Insurance)

Who Would We Recommend for Vacation Rental Insurance?

There are a few vacation rental insurance providers that our customers use. Your insurance needs to cover what you want it to cover and cater to the specifics of your rental situation.

For vacation rental insurance, one name seems to pop up again and again in various top 10 lists across the internet, and that’s Proper Insure. Proper Insure designed their policies, especially for the likes of Airbnb and Vrbo hosts.

According to Proper Insure, most short-term rental owners don’t know that their homeowner or landlord insurance does not cover exposure on most STR sites. It would help if you had insurance designed to cover the gaps that average insurance leaves open when you’re letting your home out on a short-term basis.

Proper Insure offers a range of policies, and they’ll even give you a quote in just 5 minutes! Visit www.proper.insure/short-term-rental-insurance.

According to Investopedia, American Family Insurance and CBIZ Vacation Rental Insurance are also excellent choices. Investopedia listed American Family Insurance as the Best Affordable option. CBIZ Insurance has the Best Vacation Home insurance. Investopedia went on to list American Modern as having the Best Customer Service and Nationwide as having the Best Coverage Options.

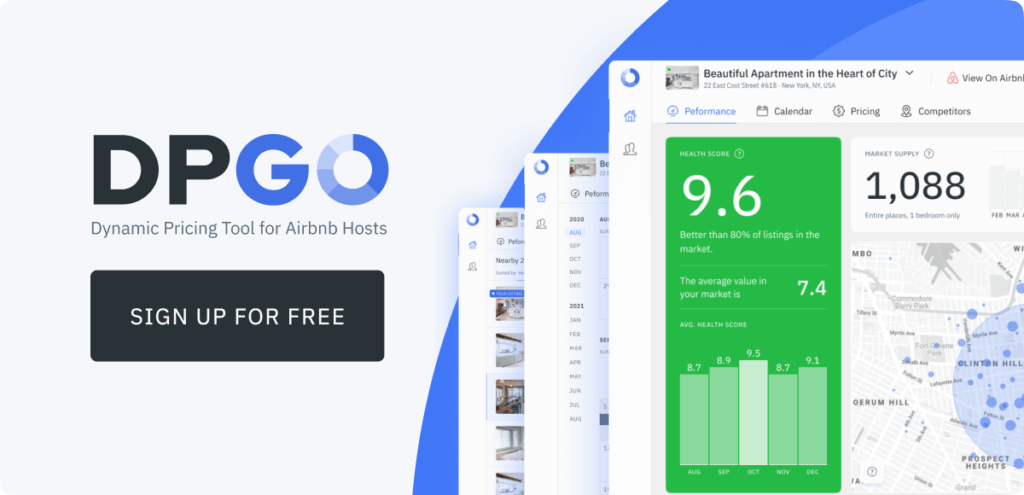

How Can DPGO Help?

Insurance isn’t free, and if you don’t have it, where are you supposed to find the extra cash to take out a policy? Well, with DPGO’s low-cost rates, anyone can afford to supercharge their business success and optimize their revenue!

Our AI-driven algorithm finds the best price for your listing daily and automatically updates it to ensure that you don’t miss a single booking! Enjoy optimized revenue and increased occupancy rates with DPGO! Sign up here for your free 30-day trial!

We know a thing or two about data so we compiled a list of the Top 10 most improved markets between February and March 2021. If you’re struggling to identify your next vacation rental investment location, try our fantastic Markets feature!

It’ll show you a range of free data specific to the market that you specify in the search bar. Here’s how to use Markets to your advantage! Did you know that Airbnb has a YouTube channel? Well, they do and the videos that they post are so helpful! Check out our favorite ones!

2 Comments

Pingback: Apartment Hunting: Do I Need Renters Insurance?

Pingback: Essential Tips for Investing in Vacation Rental Property - AsiaPosts