In today’s dynamic real estate market, Airbnb investment stands out as a unique and potentially lucrative venture. With the rise of the sharing economy, investing in properties for Airbnb has transformed from a niche strategy into a mainstream revenue stream for savvy investors. This guide is your gateway to understanding and mastering the world of Airbnb investment.

As you embark on this exciting journey, it’s essential to recognize that success in Airbnb investment doesn’t just happen by chance. It requires a blend of market insight, strategic planning, and an understanding of what makes a property appealing to short-term renters. Whether you’re a seasoned investor or taking your first step into real estate, the potential of Airbnb properties to generate significant returns is undeniable.

Airbnb investment is more than just buying a property; it’s about creating experiences for travelers while building a profitable and sustainable business. So, let’s dive in and explore the key strategies that will help you unlock the full potential of your Airbnb investment.

Why Consider Airbnb Properties?

Investing in Airbnb properties, a rising trend in Airbnb real estate investing, could offer more substantial returns compared to traditional rental investments, like conventional rental properties. Real estate investors are now keenly exploring the realm of Airbnb investment property options. Here are the pros and cons:

Pros of Airbnb Investment:

- Higher Rates Compared to Long-Term Rentals: Airbnb rental properties often command higher nightly rates than conventional investment rental properties, boosting potential income.

- Simplified Management through Technology: Vacation rental software, often used by property management companies, streamlines the administration of Airbnb rentals, making it easier than managing conventional rental properties.

- Effective Marketing: Airbnb listings offer an easy and cost-effective way to market your Airbnb property, reaching a global audience without the hefty marketing costs associated with conventional rental properties.

Cons of Airbnb Investment:

- Maintenance Demands Due to High Turnover: The frequent guest turnover in Airbnb rentals necessitates more regular maintenance compared to a conventional rental property, which can be more passive.

- Varying Occupancy Rates: Unlike conventional rental properties that typically have steady occupancy, Airbnb rental properties may experience fluctuating occupancy rates, influenced by seasonality and travel trends.

- Higher Initial Investment: Buying an Airbnb often entails a higher initial investment for furnishing and setting up the property, in contrast to conventional investment rental properties which might already be set for long-term tenancy.

To sum it up, while the Airbnb investment property market presents unique challenges, it also offers significant opportunities for those willing to navigate its dynamics. Collaborating with a knowledgeable real estate agent and considering the use of a property management company can be crucial steps in successfully managing Airbnb rentals and maximizing the returns from your investment property.

A Step-by-Step Guide to Purchasing Airbnb Properties

Follow these essential steps to kickstart your Airbnb business:

1. Select a Prime Location for Your Airbnb Investment Property:

The success of an Airbnb rental property hinges on location. Look for areas with high visitor traffic, such as bustling cities for business travelers and quaint towns for vacation rentals. A well-located Airbnb property in these areas can achieve occupancy rates above 60%, which is ideal for generating consistent passive income.

2. Understand Local Regulations for Short Term Rentals:

The Airbnb market is subject to varying local regulations. As an Airbnb host, ensure compliance with these laws, including zoning, taxes, and permits. This is crucial in maintaining the legality of your Airbnb real estate investment.

3. Property Type Matters in Airbnb Real Estate Investing:

Select your investment property based on the target market. Apartments in city centers cater to business travelers, while houses in vacation spots appeal to tourists. The type of property not only influences cost but also its appeal as a vacation rental property.

4. Budget and Finance Wisely for Airbnb Real Estate:

Set a realistic budget for your Airbnb investment, factoring in higher upfront costs for well-furnished properties and operating costs like cleaning fees. Consider Airbnb-specific financing options, such as Airbnb loans, that cater to the unique needs of vacation rental properties.

5. Comprehensive Property Search for Airbnb Rentals:

To find the best real estate deal, use a variety of sources including online listings, and personal networks. Explore beyond conventional rental property listings to include foreclosures and off-market deals, which might offer better value for your Airbnb real estate investment.

6. Work with a Real Estate Agent Experienced in Airbnb Rentals:

Partner with an agent who understands the Airbnb market and can provide insights into the best properties and negotiation tactics. Their expertise can be invaluable, especially if you’re new to Airbnb real estate investing.

7. Conduct a Thorough Analysis of Potential Airbnb Rental Properties:

Perform comprehensive comparative market analysis to evaluate the fair market value of potential properties. Assess potential rental income, startup costs, and ongoing expenses like management fees if you plan to use a property management company. Your goal should be to secure properties that offer positive cash flow and align with your strategy for Airbnb investment.

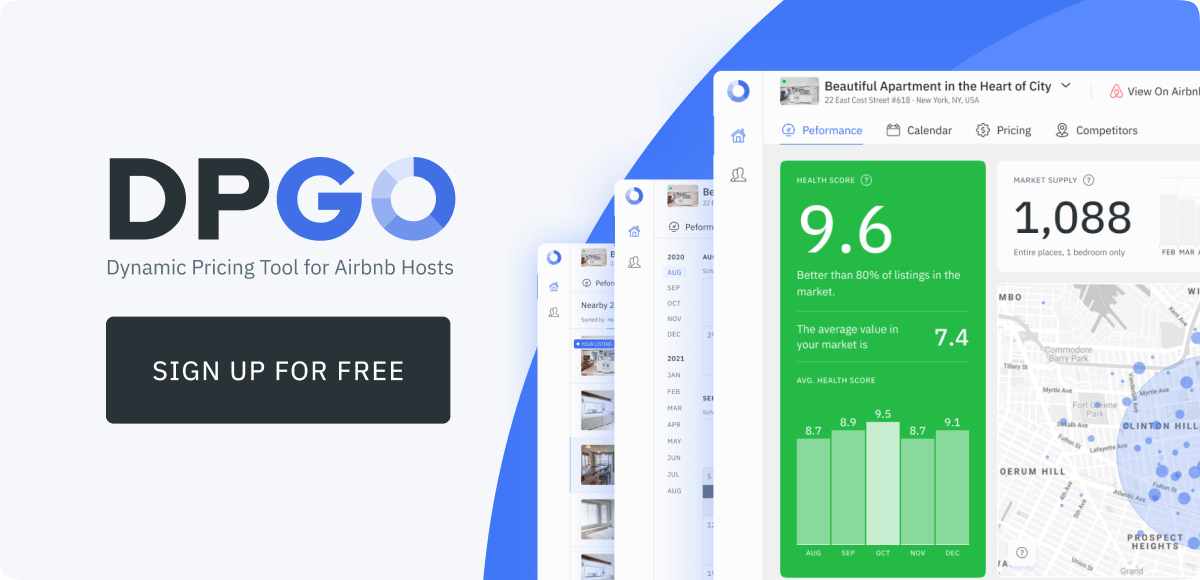

8. Leverage Real Estate Investment Tools for Efficient Analysis:

Use advanced tools for a quicker and more precise evaluation of Airbnb rentals. These tools are essential in today’s competitive Airbnb real estate market, helping you make informed decisions about your Airbnb property swiftly.

By following these steps, real estate investors can effectively navigate the complexities of Airbnb real estate investing. Whether you’re a seasoned property owner or a newcomer to the market, these strategies will help you maximize your success as an Airbnb host, providing a pathway to lucrative short-term rentals and sustainable passive income.

Maximizing Your Airbnb Investment

To truly capitalize on your Airbnb investments, it’s not just about locating the right investment property; it’s equally about managing it effectively. Proper management of your Airbnb property is pivotal in achieving the desired returns, especially considering the dynamic nature of short-term rentals.

Utilize Vacation Rental Software for Your Airbnb Rentals

Implementing vacation rental software can be a game-changer for managing your Airbnb rental. This technology streamlines the process with features like unified inboxes for all your Airbnb properties, automated messages that enhance guest communication, and efficient task management. These tools are essential in maintaining high operational efficiency for your Airbnb rentals, reducing the time and effort required compared to managing conventional long-term tenants.

Understand the Costs and Commitment of Airbnb Rentals

Managing an Airbnb property often involves higher upfront costs and more involvement than a traditional rental. While short-term rentals can yield higher returns, they require active management, whether it’s ensuring the property is well-furnished, handling bookings, or managing cleaning and maintenance.

Consider Hiring a Property Manager

For investors who own multiple Airbnb rentals or those who use their investment property as a primary residence for part of the year, hiring a property manager can be invaluable. A skilled property manager can handle the day-to-day operations of your Airbnb rental, from coordinating with guests to overseeing cleaning and maintenance. This is particularly beneficial for those who don’t have the time or inclination to manage these tasks themselves.

Balancing Airbnb Rentals with Long-Term Tenants

If you’re managing a mix of Airbnb properties and conventional long-term rentals, it’s crucial to balance the two effectively. Each type of rental has its own set of demands and returns, and managing them well can maximize your overall investment portfolio’s profitability.

By focusing on efficient and effective management strategies, you can ensure that your investment in Airbnb properties yields the best possible returns. This involves not just understanding the unique demands of short-term rentals but also leveraging the right tools and resources, and possibly professional help, to keep your Airbnb properties running smoothly and profitably

Conclusion

Airbnb rentals present a promising avenue in real estate investment. With the right property and efficient management, they can offer higher returns than traditional rentals. Follow the steps outlined in this guide to embark on your Airbnb investment journey.

Comments are closed.