The property investment market is set to boom in 2023 and we’re here to ensure that you know how to dive in head first! Identifying the right location for your investment is 99% of the battle. This week on the blog, we wanted to take you through our tried and testing steps for finding the best investment location.

How to Get Started on Finding an ‘Airbnb Near Me’

First, what do we mean by an ‘Airbnb near me’? It’s pretty simple really, we just mean an available property, near your residence that can be used as a short-term rental.

In most big cities in the United States, local governments have implemented rules and regulations to control the number of vacation rental properties. Why would they want to limit vacation rentals when they increase the capacity for tourists? Well, some experts believe that cities with high numbers of vacation rental properties often see higher residential house prices and rental rates.

Places like New York have implemented a minimum rental duration of 30 days in order to limit the number of properties standing empty when prices for residents have never been higher. Cities with harsh limitations on vacation rental stay durations are no longer regarded as safe investments and should only be approached with caution.

How to Find an Investment Property for Airbnb Near Me

Step One: Identify Your Target Guest

To start your vacation rental business, you first need to identify who you want your listing to attract. Are you catering to families? Are you aiming for couples? Do you want to attract business people and digital nomads? Deciding this will affect where you buy your property, what amenities your property needs, and logistical concerns like the number of bedrooms, size of kitchen, and parking.

Why does my target guest change the property I need? You can attract any sort of guest with low prices, but it’s unlikely that you’ll secure many family summer holiday bookings with a one-bedroom high-rise apartment. On the flip side, a business traveler is unlikely to book a five-bedroom house.

Step Two: Look Close to Where You Live

Managing a vacation rental property yourself is hard work. And it’s even harder when you don’t live close by. In fact, without these remote Airbnb management tools, we might even hedge a bet that it’s close to impossible.

Have you ever heard the expression ‘you need to make money to make money’? Well, the same is true of vacation rentals. If you want to have a successful rental property and you don’t live close by, then you’ll need money to pay for services to help you with that process. If you don’t want to do that, then buying an investment property closer to your residential property is the best option.

Step Three: Do Some Research

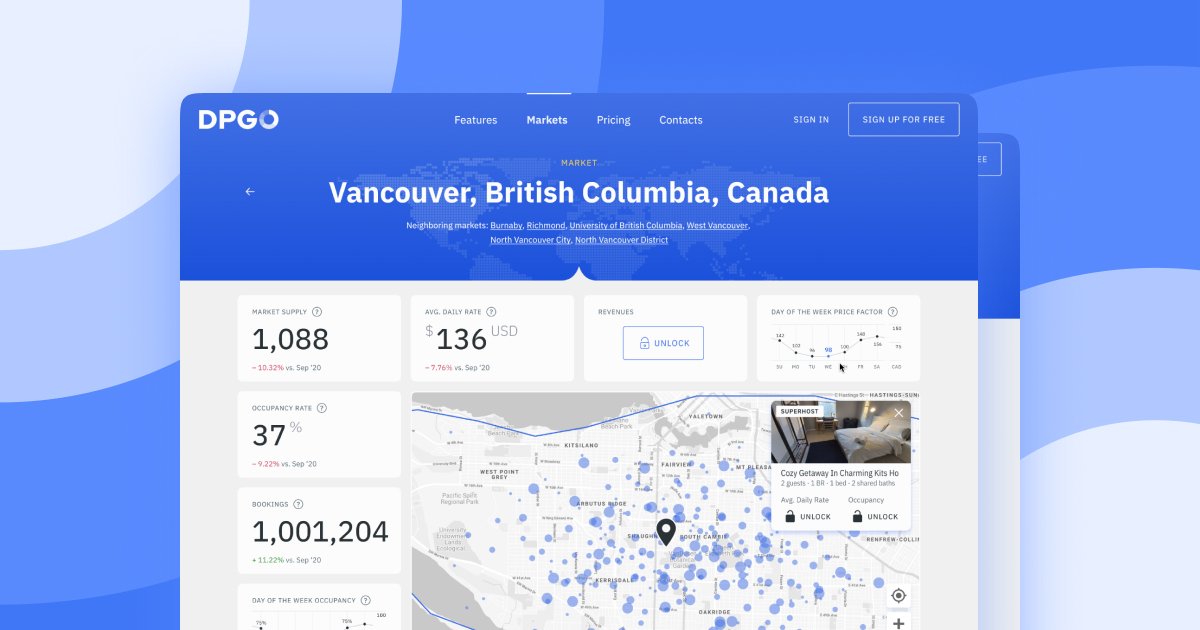

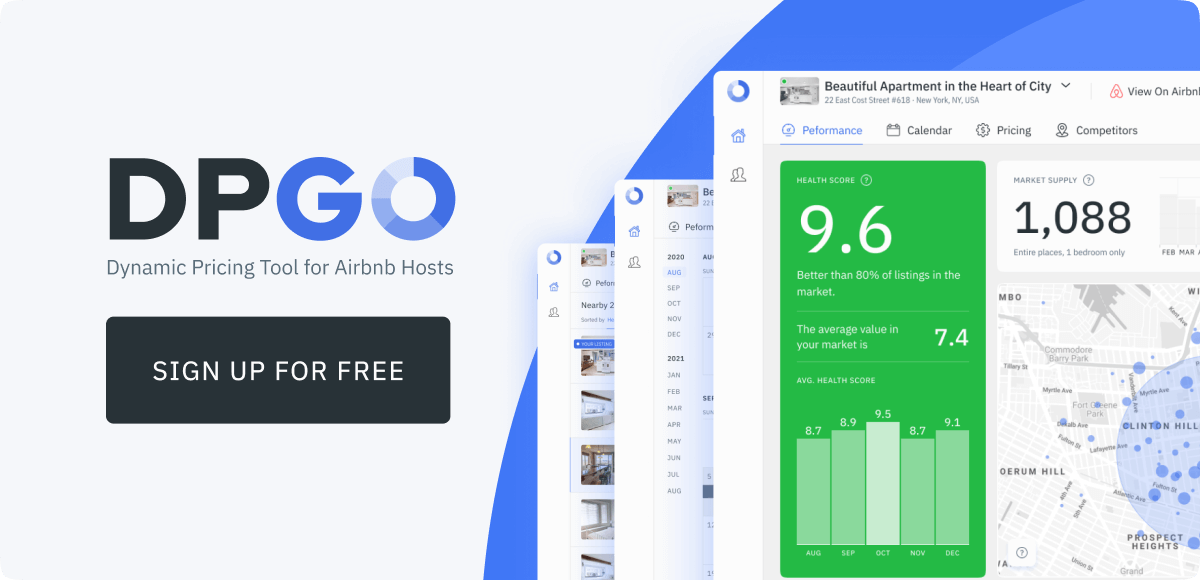

Before you start putting anything into motion, you first need to do some research. We love Markets by DPGO because it’s free, it’s easy to use and it gives you a snapshot of the overall investability of a specific target market.

There are other investigative tools on the market, but you’ll have to pay for them. Spending money on research should only be considered once you’ve narrowed down your potential investment locations to a select few. We would advise making a list, then narrowing it down to perhaps three or four serious contenders.

Step Four: Look at Critical Metrics

Being a property investor and finding an ‘Airbnb near me’ property is not an easy task. In fact, many of the data sets you’ll need to consider will be completely different from what you’re used to.

If we have to pick four data sets, we’d go with the big four. Namely, Average Daily Rate, Occupancy Rate, Day of the Week Occupancy, and Market Supply.

Average Daily Rate shows you how much other hosts in your local market are charging on a daily basis. We calculate this by looking at the cost of the confirmed booked nights in your area over the next 30 days. It changes as more days are booked.

Occupancy Rate shows the percentage of active listings that have confirmed bookings in the next 30 days. This will help show you how popular the market is, and which months are the most popular within that market.

Day of the Week Occupancy shows which days of the week see the highest occupancy rates. Most markets will see a spike in occupancy on Friday and Saturday. Wednesdays are usually the least popular.

Market Supply shows how many active listings are in your target market. While a market’s current Market Supply may not be super useful, a historical comparison is incredibly useful. This will show how many listings are active per month, and therefore which months are the most popular.

Step Five: What Are the Vacation Rental Rules in Your Target Area?

New York is arguably the most famous and popular city to mandate limitations on short-term rentals. The New York local government has implemented a 30-day minimum stay policy effectively ending short-term rentals in the city. You can still rent out a room in your home for a few days but entire property rentals have to have a minimum stay policy of 30 days.

Once you have a few potential locations on your list, the next step should be to ascertain what the city’s laws are in relation to short-term rentals. If you’re only permitted to rent out a room in your residential property, then it is not the ideal investment location for a whole-property short-term rental.

Conclusion

Finding the right property is tricky, but deciding where to look for that property is harder. As a future short-term rental host, there are so many things you need to consider when finding the right location for your investment property. Consider all of the factors above and you’ll be on the right path in no time!

Comments are closed.