Most people forget that investing in property costs more than just buying the property in question. You have to add on a myriad of costs and tax is probably one of the last on the list for most people. Of course, if you’re a professional real estate investor, then you’ll know all the hidden and forgotten costs but first-time investors might not be so informed about state property taxes. This is why we wanted to draft a list of the states with the highest property taxes in the United States!

As it is not set by the federal government, property tax varies from state to state. We’re not saying that it should be your primary concern, but knowing the property tax of the state you want to invest in is pretty important if you want to ensure your investment cost breakdown is sound.

Property taxes do change every year and they depend on the value of your property, so knowing what you’re getting into is key. If you’re looking at investing in smaller-value properties then property tax won’t be a critical factor but for those looking to invest in bigger properties aimed at families, property tax could get expensive and it could do so very quickly.

As we stated above, property taxes do vary according to the value of your property so the statistics stated below are average calculations. We used property tax rates, property tax payments, and house values from Property Taxes By State: A Comparative Look At The Highest To Lowest States’, which you can find on RocketMortgage.com.

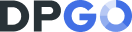

States with Highest Property Taxes & Highest Average Property Taxes

10. Rhode Island

Rhode Island is the home to Brown University, Providence, Newport, and plenty of beautiful sandy shores. The state of Rhode Island’s average property tax is 1.63%. While this number is not particularly high, property owners in Rhode Island pay an average of $3,548 in property taxes annually. Primarily, this is due to the high average property value. In 2021, the average home value in Rhode Island was $261,900.

9. New York

New York City is the definition of an iconic city. The Big Apple sees millions of tourists each year with Trillist.com forecasting that 65 million visitors will walk the streets of New York City in 2023. This is compared to 56 million in 2022. Real estate property owners in New York State pay a property tax rate of 1.72%, which amounts to $3,749 in average property taxes. The average house price in 2021 was $313,700.

8. Nebraska

Nebraska is covered in prairies of the Great Plains and this stunning natural beauty draws many visitors to the state. In Nebraska, property owners pay an average of 1.73% in property taxes. The average home value in November 2020 was $155,800 and this translates to an average annual property tax payment of $3,754.

7. Texas

The lone star state doesn’t really need an introduction. International tourists have heard of Texas and they flock to the state to experience the iconic southern hospitality. The average property tax in Texas is 1.80% and this translates to an average annual payment of $3,907. The average property value in 2021 was $172,500.

6. Wisconsin

Wisconsin borders two of the Great Lakes and the state even boasts the Harley Davidson Museum. Property owners pay an average of $4,027 in property taxes annually with an average tax charge of 1.85%. The average home value is slightly lower than most states on this list so far with a figure of $180,600.

5. Vermont

The state of Vermont is a hiker’s paradise with its undisturbed forest areas and countless outdoor activities that attract many visitors, both local and international. The average property tax sits at 1.90% and that translates to a payment of $4,135 annually. The average property value in 2021 was $227,700.

4. Connecticut

The New York Post recently reported that Connecticut was fast becoming a dining destination recognized on a global scale. It’s also known for being home to Yale University. This will have a great impact on the short-term rental industry! The average property tax in Connecticut is 2.14% and the average property value in 2021 was $275,400. The average property tax paid annually by Connecticut homeowners is $4,658.

3. New Hampshire

New Hampshire’s impressive role in the Revolutionary War means it attracts history buffs from all across the country. This state is one of three with a property tax of over 2%. New Hampshire’s average annual property tax payments are $4,738, which is the second-highest average on this list. The percentage average is 2.18% and this is based on the average home value of $261,700.

2. Illinois

Illinois is home to the great city of Chicago and, as we all know, the city attracts plenty of tourists on an annual basis. Homeowners in Illinois pay an average of 2.27% in property tax, which works out to $4,942 charged in property taxes. The average home value in 2021 was $194,500.

And at the top of our list of states with the highest property taxes is…

1. New Jersey

Maybe its proximity to New York City boosts the average property value and therefore property tax, but either way, New Jersey is top of our list! The highest average property taxes are in New Jersey and the 2022 rate was 2.49% with an average home value of $335,600 (also the highest on our list). Based on this, New Jersey homeowners pay an average of $5,419 in property taxes. This eye-watering figure shouldn’t scare you away from owning property in New Jersey but it is important that you understand what you’re getting yourself into before you buy!

States with the Lowest Property Taxes

Now let’s take a look at the states with the lowest property taxes. These low property tax rates could be due to a number of factors. According to the New York State Department of Taxation and Finance, “Local governments determine tax rates by dividing the total amount of money that has to be raised from the property tax (the tax levy) by the taxable assessed value of real property in the municipality.”

These states with the lowest average property taxes do not necessarily represent ideal investment locations, but they do mean that over and above your property investment cost, your taxes will not be an overwhelming concern. On average, these states have a collective average property tax rate of just 0.52%.

10. Wyoming

The great state of Wyoming is known for its natural beauty, mountainous terrain, and the stunning capital of Cheyenne. The Airbnb business in Wyoming is growing, but the average occupancy rate sits at around 38%. The property tax rates in Wyoming are 0.61%, which amounts to $1,319 in property taxes. This number is based on the average home value, which is $220,500 in Wyoming.

9. Nevada

Nevada is home to Las Vegas, large stretches of desert, and some of the most beautiful scenery in all of the United States. The property taxes, on average, in Nevada are $1,310. This amounts to a property tax rate of 0.60% and is due to the average property value sitting at $267,900.

8. West Virginia

West Virginia is aptly known as the Mountain State, and for good reason. This eastern state is well-known for its outdoor activities and a plethora of activities for nature lovers. The property tax rates in West Virginia are mild by any standards, with a rate of just 0.58%. This correlates to an average property tax paid by West Virginia property owners of $1,269. The average real estate home value was recorded at $119,600 in 2021/2022.

7. Delaware

Delaware, known as the First State, is famous for its sandy beaches and beautiful views of the Atlantic Ocean. Although Delaware is small in size, it’s big in attractions. Folks looking for a beach vacation a little closer to home should seriously consider Delaware for their next summer break. Delaware has a comparatively low real estate property tax at just 0.57% which, based on the average property value of $251,100, equates to an average cost of $1,431.

6. South Carolina

Sandwiched between Georgia and North Carolina, South Carolina is known for its history, the city of Charleston, and Myrtle Beach. The property taxes are comparatively low compared to the rest of the United States. South Carolina has an identical real estate property tax rate of 0.57% as Delaware. In South Carolina, however, this amounts to $1,238 as the average real estate property value sits at $162,300.

5. District of Columbia

The District of Columbia, or Washington DC for those who didn’t know, is not technically a state, nor does it fall under any other state. The average house price in the District of Columbia is a whopping $601,500, with property taxes of 0.56%. This amounts to a property tax payment of $1,221, on average per annum.

4. Louisiana

Louisiana sits on the shores of the Gulf of Mexico and is home to the iconic city of New Orleans. As a state, Louisiana boasts a rich and complex history, with many travelers choosing to visit New Orleans for the annual Mardi Gras celebration. The average property taxes paid in Louisana in an annual period is $1,187. This is based on a 0.55% property tax rate and an average house value of $163,100.

3. Colorado

The beautiful state of Colorado is renowned for its natural wonders. It has it all: arid deserts, river canyons, and snow-covered mountains. The average rate of property taxes sits at 0.51%, which equates to $1,113 paid annually. This was based on the average house value of $343,300.

2. Alabama

Alabama is synonymous with the American Civil Rights Movement and the state is steeped in history. The capital is Montgomery and it’s home to the Rosa Parks Museum and Martin Luther King Jr’s church. The average property taxes paid annually in Alabama is $895. This amounts to 0.41% in terms of property tax rates. The average house value in Alabama is $142,700.

1. Hawaii

The tropical island of Hawaii is a paradise on Earth. Travelers flock to see the sandy beaches, crystal clear water, and delectable sunshine. It turns out that property taxes in Hawaii are the cheapest property taxes in the entire United States. The property tax rates across the country vary massively according to local governments but if you’re looking for the state with the lowest rates, Hawaii is the state for you.

The property tax rates of 0.28% equate to an annual payment of $606, based on an average house value of $615,300.

How Can DPGO Help You Grow Your Vacation Rental Business?

In an ever-changing world of prices, trends, and statistics, the only thing you can depend on is real data. Using data to make critical business decisions means you’re removing ‘best guess’ factors and basing your decisions purely on facts. Your pricing should work in the same way.

DPGO has a range of pricing plans that will allow you to access the data and services that you need without paying for things that you don’t want. The data that we use for our price analysis and insight widgets is collected on a constant basis. We are always monitoring the market and if you make use of DPGO’s dynamic pricing services, you will be kept competitive 24/7, 365.

If you’re a vacation rental host looking for a service to take the stress out of your pricing strategy, DPGO offers the following features:

- AI-driven dynamic pricing

- Daily pricing updates in keeping with your chosen pricing strategy

- A choice of three pre-defined strategies, as well as the option to build their own

- Easily actionable special pricing rates like discounts, weekend adjustments, seasonal price changes, and more

- Real-time local market data

- Yield management

- Growth performance reporting

- Minimum night stay controls

- Mobile device support for on-the-go management

Comments are closed.