Airbnb first announced its intention for an IPO in July 2020, marking a pivotal moment for the company and its stakeholders. By August, the Airbnb IPO was confidentially registered, and by November, details of this move became public.

This led to an exciting development: a select group of Airbnb hosts were invited to invest in the company, contributing towards the ambitious $3 billion target aimed at elevating Airbnb’s market capitalization to an impressive $30 billion. The event marked one of the most significant market debuts of the year, significantly impacting the stock market.

What is the Airbnb IPO?

An Initial Public Offering (IPO) is a process by which a private corporation becomes publicly traded on the stock market, offering shares to public investors. This transition allows companies like Airbnb to access funds from the broader public while retaining majority control. For Airbnb, led by CEO Brian Chesky, the IPO listing was a crucial step, especially after a challenging year.

The company had to reduce its workforce by 25%, eliminating 1,900 jobs due to financial strains. The Airbnb IPO signifies a monumental shift in Airbnb’s business, allowing it to secure additional funding and solidify its position as a market leader. Airbnb’s successful IPO not only boosted its stock price but also indicated CEO Brian Chesky and the Airbnb co-founders’ commitment to the platform and its host community.

This move is seen as a long-term investment in Airbnb’s future, potentially marking it as a good investment. The introduction of concepts like the host endowment fund further demonstrates Airbnb’s dedication to its community, ensuring that the Airbnb leader continues to innovate and grow in the ever-evolving travel industry.

What Does The Airbnb IPO Mean for Hosts?

Currently, the transition to public status means minimal immediate change for hosts and users. Airbnb’s IPO success and its transformation into a public company have left the daily operations of most hosts and users largely untouched.

The notable change comes for those select Airbnb hosts who were able to participate in the private funding round, becoming individual investors as Airbnb hit the stock market. This opportunity extends to broader market investors and current shareholders, who, thanks to the IPO, can now trade Airbnb stock freely. The Airbnb IPO, leading to a significant boost in Airbnb’s debut market capitalization, offers these stakeholders high demand and potential financial gain.

Matt Frankel from MillionAcres notes, “The main impacts of the company’s initial public offering generally concern insiders, early investors, and the rental giant’s backers, including Airbnb CEO Brian Chesky and co-founders turned employees, who now have the liberty to sell their shares publicly.” Additionally, the IPO represents a major evolution for Airbnb itself, enhancing its ability to raise funds in public equity markets, an essential step for growing Airbnb further.

According to CNBC, a few host-turned-shareholders reaped substantial rewards, with initial stock purchases on December 10th yielding up to $15,000 – a testament to the high demand and Airbnb’s market caps surge. Unsurprisingly, an increasing number of Airbnb hosts are seeking share opportunities, eager to partake in the entire IPO journey, which has marked a new chapter in the global expansion of the home rental giant, operating in nearly every country.

This transition has unfolded amidst challenges like the coronavirus pandemic, which notably curbed tourism, yet couldn’t deter the hitting IPO and growing interest from the host community and potential investors alike.

What’s Next for Airbnb as a Company?

Well, that question is slightly more complicated. Listing an IPO usually means that a company has big plans for the future. It also often means they need capital to make it happen.

Airbnb as a company hasn’t ever shied away from diversifying its offerings. It started with general hosts, then went on to offer experiences, and then Airbnb Luxe and Airbnb Retreats.

In terms of Airbnb development in 2021, experts agree that we’ll likely see bigger development, more stock purchasing opportunities, and hopefully more growth for every Airbnb host.

What Has Airbnb Said About Their IPO?

The team at Airbnb has been remarkably quiet on the IPO listing. Their initial announcement was published on August 19, 2020, and the company has remained largely quiet since.

We’ll update this page if any official statements get dropped, just to keep you all in the loop!

What Are the Industry Experts Saying About the Airbnb IPO?

Keith Noonan, writing for Nasdaq.com, explained that the Airbnb IPO was one of the most exciting prospects of the year. He made plans to make it his biggest investment of the year. That soon changed when he saw the debut of Airbnb’s valuation and share price.

“By the time Airbnb’s first day of trading rolled around (Dec. 10), reports emerged that the stock would likely open with shares trading in the range of $150 per share. It’s important to understand how the company’s valuation could more than double before shares even became available to the average investor.”

He goes on to say that, “Predictably, Airbnb followed suit. Shares opened at $146 per share – 115% higher than the actual IPO price and 192% higher than the top of its original pricing range. That meant the company opened with a market capitalization of roughly $102 billion.”

At the time Keith Noonan wrote his article, 471 companies went public this year. It was the biggest market debut year since 1999. It’s no surprise when you think about it, as 2020 was a disastrous financial year for many. Large private companies suddenly found themselves in need of public funding.

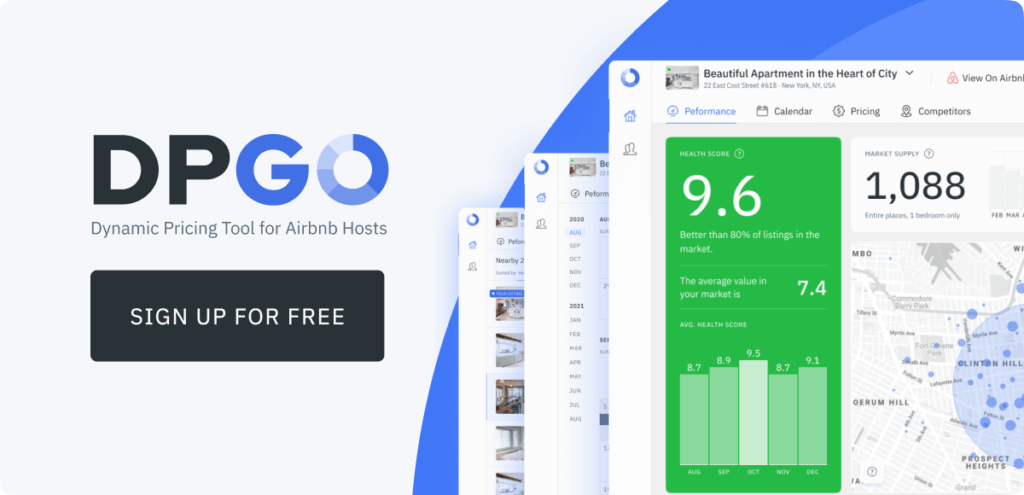

As industry experts, we understand the stresses of being an Airbnb host, especially now. You can say goodbye to income insecurity with dynamic pricing from DPGO! We offer all sorts of insights into your local Airbnb market, and you can try DPGO for free for 30 days!

1 Comment

Pingback: Airbnb streamlines fees as it moves toward biggest hosts - NYK Daily